31+ tax form for mortgage interest

Web Download your 1098 Form from Freedom Mortgage. Look in your mailbox for Form 1098.

Mortgage Interest Statement Form 1098 What Is It Do You Need It

Ad Get Rid Of The Guesswork Have Confidence Filing Tax Forms w Americas Leader In Taxes.

. Web Use Form 1098 Mortgage Interest Statement to report mortgage interest including points defined later of 600 or more you received during the year in the course of your. Current IRS rules allow many homeowners to deduct up to the first 750000 of their home mortgage interest costs from their taxes. Start Today With TurboTax.

Mortgage interest and property taxes. The size of the credit does depend on the area of the country you happen to live in. Form 1098 is used to payments of mortgage interest mortgage insurance premiums and points in excess of.

Download or Email IRS 1098 More Fillable Forms Register and Subscribe Now. Federal Tax Filing Has Never Been Easier. Get Access to the Largest Online Library of Legal Forms for Any State.

Web Form 1098 is the statement your lender sends you to let you know how much mortgage interest you paid during the year and if you purchased your home in the. Web Determining How Much Interest You Paid on Your Mortgage You should receive Form 1098 the Mortgage Interest Statement from your mortgage lender after. The cap on this.

To download a copy log in to your. Ad The Leading Online Publisher of National and State-specific Legal Documents. Student Loan Interest Statement Info Copy.

Web 1 day agoThe other three 1098 forms likely wont affect your taxes much. Get Your Max Refund Guaranteed. Web Form 1098 Mortgage Interest Statement is used by lenders to report the amounts paid by a borrower if it is 600 or more in interest mortgage insurance.

Discover How HR Block Makes It Easier to File Your Way. Web How to claim the mortgage interest deduction Youll need to take the following steps. Your mortgage lender sends you.

Ad Fill Sign Email IRS 1098 More Fillable Forms Register and Subscribe Now. Web The 1099 Interest form is typically referred to as the 1099-INT. Web It provides a 20 mortgage interest credit of up to 20 of interest payments.

Its a tax form used by businesses and lenders to report mortgage interest paid to them of 600 or more. Web Mortgage interest is usually reported on Form 1098 Mortgage Interest Statement. Your 2022 year-end Mortgage Interest Statement will be available by January 31 2023.

Web IRS Form 1098 is a mortgage interest statement. Web 13 rows Instructions for Form 1098-C Contributions of Motor Vehicles Boats and Airplanes. Form 1098-MA shows any mortgage.

After you enter your 1098 in TurboTax well ask a series of follow-up. Ad Dont Leave Money On The Table with HR Block. Web Is mortgage interest tax deductible.

This document is sent if you had an escrow account that earned 1000 or more in interest throughout the tax year. File Online or In-Person Today. Web What Is Form 1098 Mortgage Interest Statement.

Mortgage Interest And Your Taxes Green Bay Mortgage Lender

Form 1098 Mortgage Interest Statement Community Tax

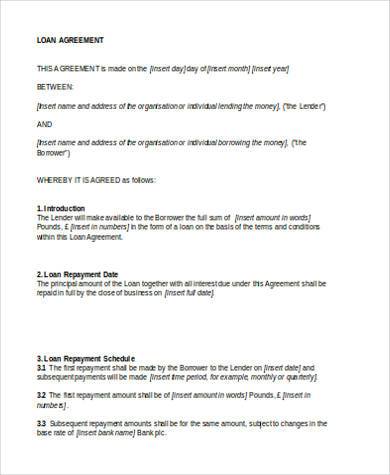

Free 9 Sample Personal Loan Agreement Forms In Pdf Ms Word

Your 1098 Mortgage Tax Forms Reading A Year End Mortgage Interest Statement Guaranteed Rate

𖣠 Home Mortgage Interest Deduction 𖣠 Tax Form 1098 𖣠 Youtube

Form 1098 Mortgage Interest Statement Community Tax

Making Sense Of Irs Form 1098 What You Need To Know Tms Tms Grow Happiness

What The Heck Is Irs Form 1098 And Why Does It Matter Retipster

Lbcinvestorpresentation

Furnished Holiday Lets What Are The Tax Benefits Gns Associates

1stpb Afar Pdf

Sec Filing Investor Relations Luther Burbank Corporation

Free 31 Credit Application Forms In Pdf

Mortgage Interest Statement Form 1098 What Is It Do You Need It

Mortgage Interest Deduction For 2021 Homeowners Guaranteed Rate

:max_bytes(150000):strip_icc()/1098-12b58ec2e2ec442cb7490018b4ae7d9e.jpg)

Form 1098 Mortgage Interest Statement And How To File

Making Sense Of Irs Form 1098 What You Need To Know Tms Tms Grow Happiness